Everything You Need to Know About Budget & Tax When Offering Rewards in Your Employee Engagement App

Everything you need to know about encouraging optimal participation in your company’s employee engagement app, how much you need to budget for this, and how it all works in terms of taxation.

I’m writing this article for two reasons:

- We receive a lot of questions on this subject from both potential customers and customers who are about to launch our Eloops employee engagement app at their organizations.

- We use the Eloops app ourselves internally, and as the COO of the company, I care deeply about these questions and have dedicated much thought to answering them.

What will encourage optimal participation in your employee engagement app?

1. Keeping your in-app content interesting – employees who enjoy their experience when visiting your app will keep coming back! Eloops customers can access the vast range of expertly-created pre-made content items designed to match every occasion and need that is housed in our continually refreshed content marketplace.

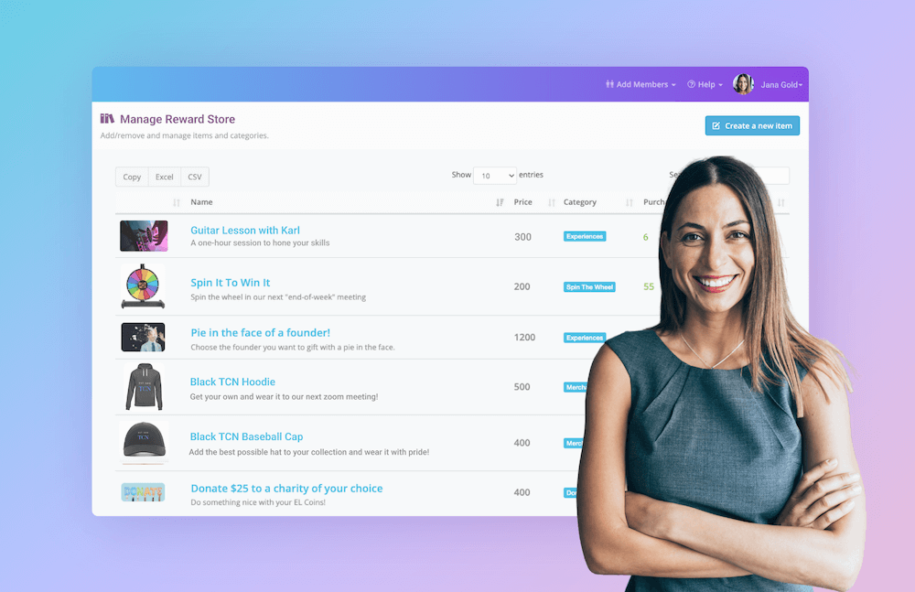

2. Rewarding employees for participation – incentives generate interactions! For example, Eloops lets you reward every interaction in your employee engagement app with your own, branded virtual company coins.

3. Adding game dynamics – gamification makes consuming & interacting with your content rewarding & fun! Eloops has quizzes with timers and leaderboards, social feed challenges that reward submissions, and virtual coins that app members can collect through in-app activity then redeem for rewards of their choice in your virtual reward store.

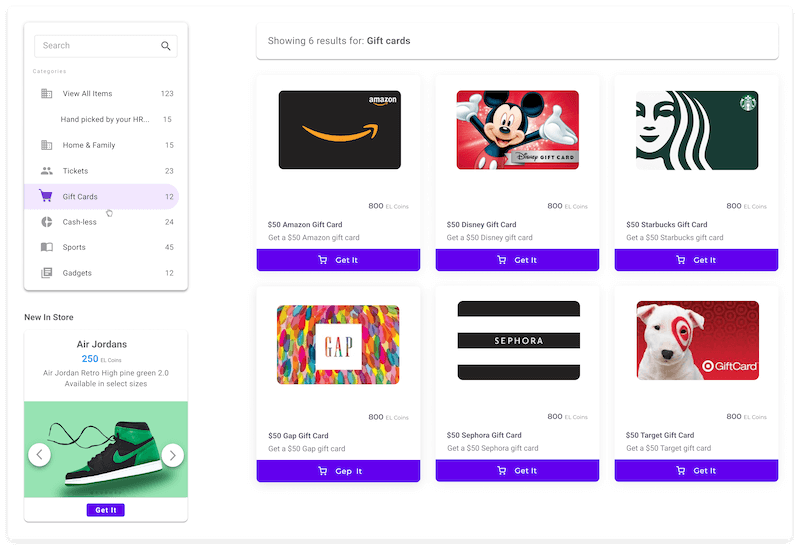

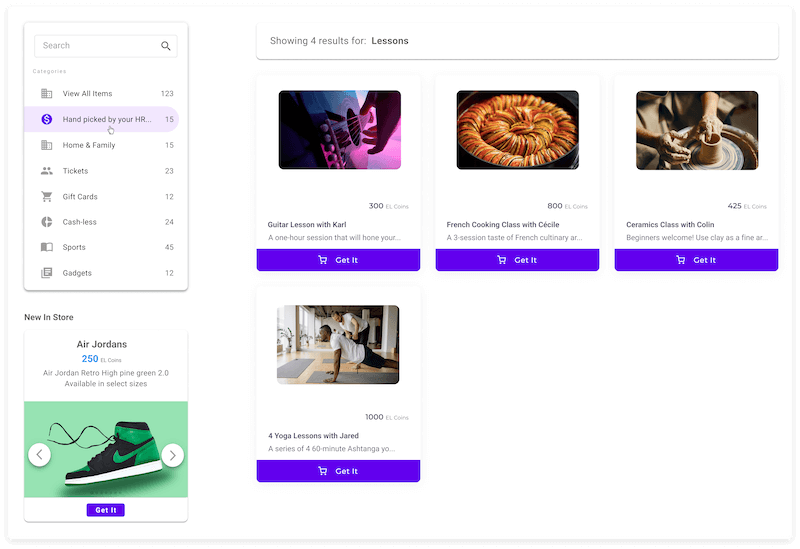

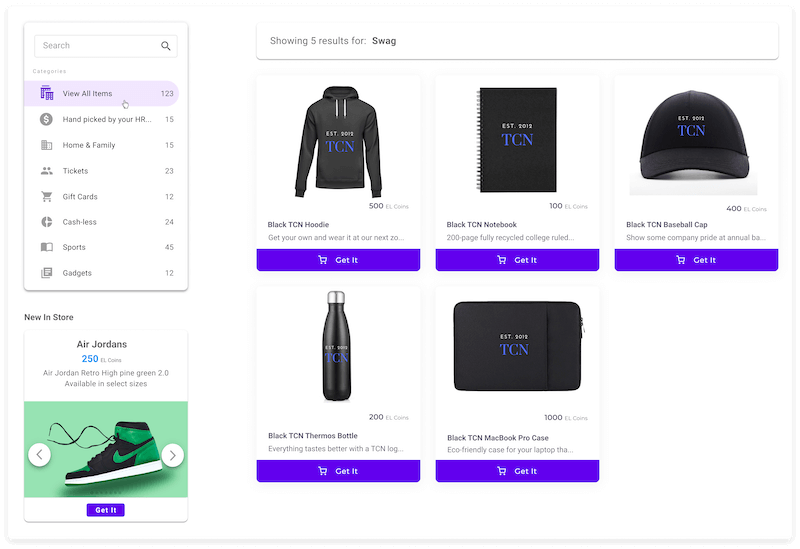

4. Offering the right items at the right prices in your reward store – the items that are most desired by your workforce will generate greatest motivation to ‘play’! With Eloops you can ensure your store contains things your employees will want and that collecting enough coins to get them is achievable. You can add items with monetary value such as discount vouchers for trips abroad, gift cards for Amazon etc. And in addition, ‘cashless’ items that don’t have a monetary value but provide unique experiences your employees will appreciate and enjoy, for example, lunch with the CEO or a guided tour of one of your production lines.

How much do you need to budget?

The challenge is to incentivize employees with significant rewards they will value while not creating expenses the company is unprepared for or is not in a position to bear. We recommend that the average reward for participation in a company’s digital initiatives be no less than $50 per employee per year.

How does all this work in terms of taxation?

Gift cards and other cash-based rewards are subject to tax, so you have two options:

– first, you can credit the value of the gift to your salaried employee. In this case, the employee will be taxed and lose part of the gift they received. Unfortunately, this is likely to reduce the employee’s enthusiasm and appreciation of the reward.

– the second option is to add the tax as a ‘cost’ in addition to the value of the gift, thereby increasing the company’s expenses.

Company swag is not subject to tax if its value is not significant (around $100 per year per employee).

Cashless items are not subject to tax.

For more information on employee reward tax issues, I encourage you to read the IRS article “De Minimis Fringe Benefits.”

Would you like to see Eloops in action? Book your demo today!